Gold Step Back

Gold step back: In may I got allured by gold returns in period 2000-2025 which have shown very similar returns and seemingly opposite trends. The thought of hedging against risk-adjusted returns was so fascinating that I allocated 12% of my 2025 end-of-year portfolio allocation.

The idea came when back in May I read the analysis by [earlyretirementnow] about gold allocation which he advised at 10-15%. Despite this advice he noted that he didn’t see enough pros in gold and remained 100% in equities. Like a real pro, I decided that after seeing the reddit post of the gif that compared the S&P and GOLD trend in the last 20 years I went all in. No one can change my mind. Gold is definetly the way to go.

reddit-sp500-vs-gold-1990-2023.mp4

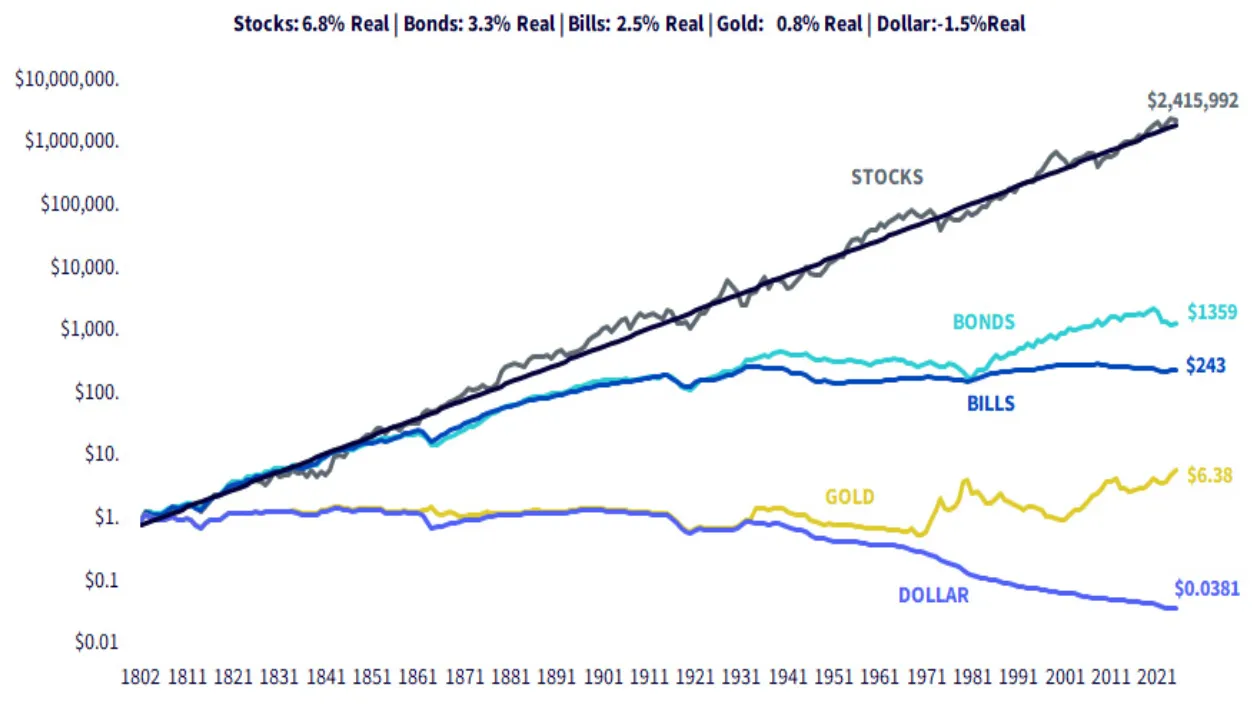

And here I am, four months later, researching evidence to back my gold allocation. This time instead of looking in the last decade I wanted a larger horizon. Of course, what I found was overwhelming evevidence of exactly the opposite of that. This is perfectly summarized by [WisdomTree]:

Gold and stocks serve fundamentally different roles in a portfolio, and history makes their contrast crystal clear.

Over the past two centuries, gold has been a relatively stable store of purchasing power, offering real returns of just 0.8% per year—barely ahead of inflation. It’s inert by design: it yields nothing, it doesn’t grow, and it doesn’t compound. Its primary function is wealth preservation, especially in times of political upheaval, monetary disorder or inflation shocks. In contrast, stocks represent dynamic claims on real assets—productive enterprises with reinvestment, growth and innovation embedded in their structure. From 1802 to April 2025, a diversified equity portfolio delivered real returns of nearly 7% annually, compounding purchasing power exponentially over generations.

But sure, let’s look at the opposite side. There is the paper [The role of gold in investment portfolios, Wagner, 2024] that like in the [earlyretirementnow] advises 17% gold, but they are doing it on a 60/40 equity/bonds portfolio where their target audience seems to be the average american which can pull out all their investment from a moment to another… I am 100% equity… What was I thinking.

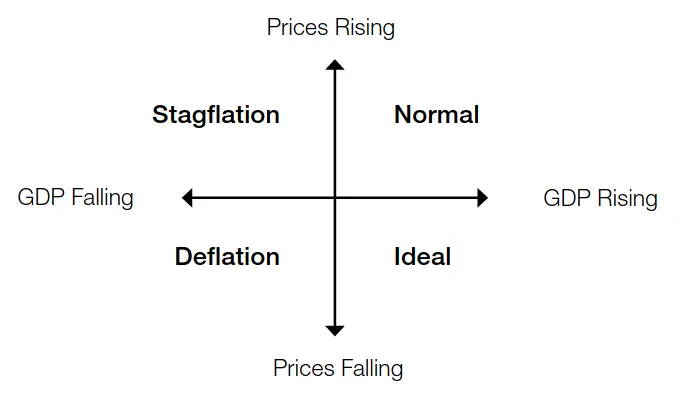

Stagflation: Btw, given the low profile audience the terminology was super easy and I finally get to learn what stagflation is, after hearing it many times in Ben Felix vidoes. It’s basically the situation where GDP falls and prices raise.

This word even though sounds super bad, it’s not as bad as deflation. Deflation is bad. Deflation happens very rarely (2% of the time) compared to stagflation (12%), and Wagner writes:

Deflation is a destructive situation in which economic activity and prices are falling. Japan serves as a modern case study of the deleterious effects of this environment. Governments generally attempt to avoid this situation at all costs, even if that means printing money and risking an overshoot into higher-than-desired inflation levels.

Interesting. At least I feel stupid for buying gold and intelligent for knowing a new word I can show off to my coworkers.

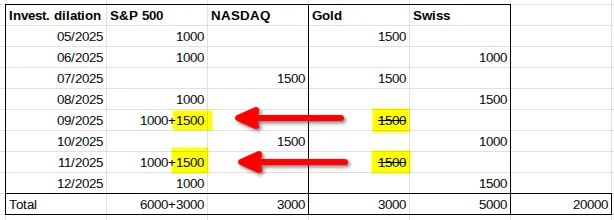

This is the new allocation, less go with stockss. I’m sure americanz know what they are doing and the market will grow to the staz and beyond.